is a car an asset for fafsa

Chime is an online-only financial technology company that partners with two banks to offer checking and savings accounts. A secured loan is a form of debt in which the borrower pledges some asset ie a car a house as collateral.

EFC is an index score that is used to determine a level of financial need.

. The FAFSA also asks about untaxed income which means that withdrawing from a Roth IRA to pay for college expenses could also reduce your childs financial aid package said Mark Kantrowitz the. The grocery basket analogy. Your car is a depreciating asset.

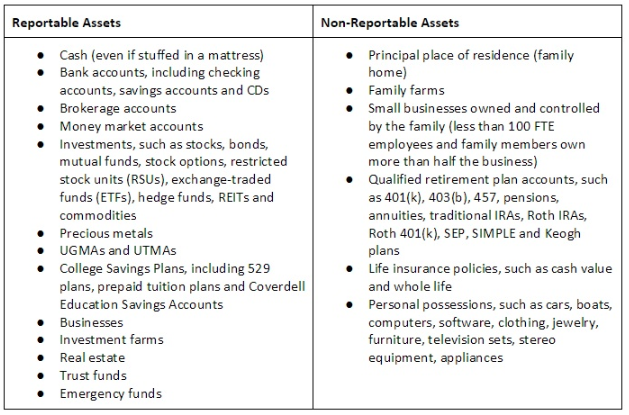

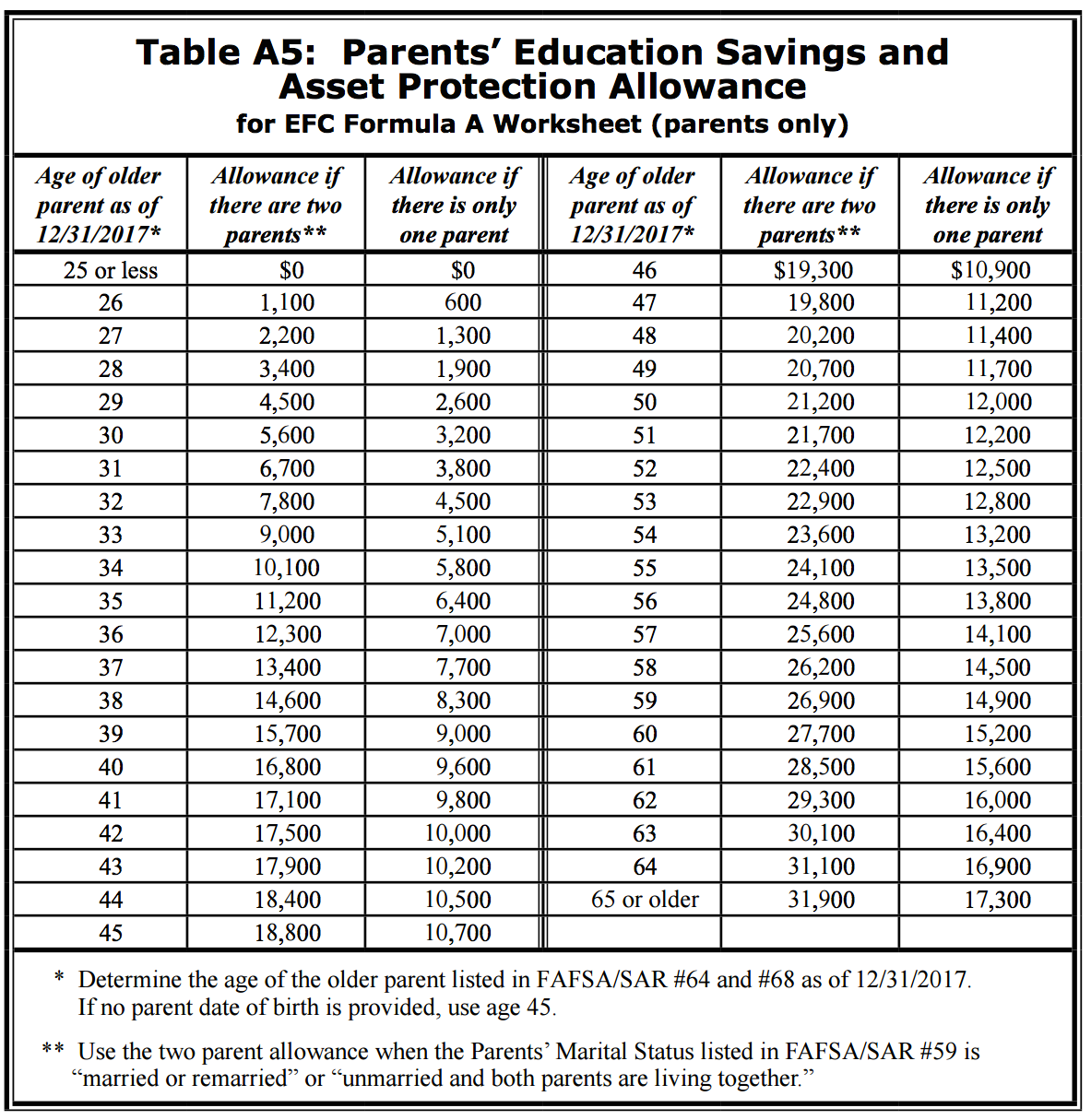

A mortgage loan is a very common type of loan used by many individuals to purchase residential property. The only way to NOT declare this money is to spend it. Student assets increase the EFC by 20 of the asset value on the FAFSA and 25 on the CSS Profile Parent assets are assessed on a bracketed scale increasing the EFC by up to 564 on the FAFSA and up to 5 on the CSS Profile.

Nearly 70 soon will have to confront the reality of student loan debt. Retirement savings dont have to be reported as an asset on the Free Application for Federal Student Aid butand this is a big but in your caseonly if the money is in a qualified account. The Higher Education Act of 1965 specifies that trust funds must be reported on the FAFSA by including trust funds within the definition of the term asset at 20 USC 1087vvf1.

One of the most common mistakes on the FAFSA is to report retirement plans and net home equity as investments. Any payments received during the base year the prior-prior year must be reported as income on the FAFSA. Because its important to complete the form correctly this chapter discusses some of the more difficult questions that arise.

An asset is property that the family owns and has an exchange value. The FAFSA is the primary way to apply for college financial aid but you may also be required to fill out the CSS Profile when you attend about 400 different institutions in. This can reduce your total reportable assets.

The statute does not provide any exceptions. With EFC lower is better. The short answer is yes generally your car is an asset.

Asset allocation refers to the mix of investments you hold. But its a different type of asset than other assets. Colleges states and the federal government give out grants which dont need to be repaid.

The FAFSA form collects current data as of the day of signing the FAFSA form about cash savings and checking accounts investments businesses and investment farms. It doesnt work like a traditional neighborhood bank but its. Small businesses If your family owns a small business you wont need to report it on the FAFSA.

If you simply remove it from your account but still have the cash you must still declare it as an asset as CASH is an asset. A sound asset allocation strategy ensures your investment portfolio is diversified and aggressive enough to meet your savings goals without unnecessary risk. Small businesses are defined as businesses with under 100 full-time employees.

If you have a large auto loan consider taking money out of a reportable asset to help pay it off. Most are awarded based on your financial need and determined by the income you reported on. You cant leave an asset off the aid application simply because you intend it.

More than 44 million college students recieved some sort of college diploma in 2021 from associates to doctorate or professional degrees but whatever else that can be said about the Class of 21 we know this. Shifting an asset from a reportable category to a non-reportable category can help shelter the asset on the FAFSA. You MUST put this down on your FAFSA.

Those with balances of 200000 or more get access to two dedicated financial advisors who can answer questions about a wide range of issues including retirement planning estate planning taxes. The FAFSA4caster is a free financial aid tool from the federal government that allows you to practice filling out the Free Application for Federal Student Aid FAFSA and estimate the financial. These are non-reportable assets.

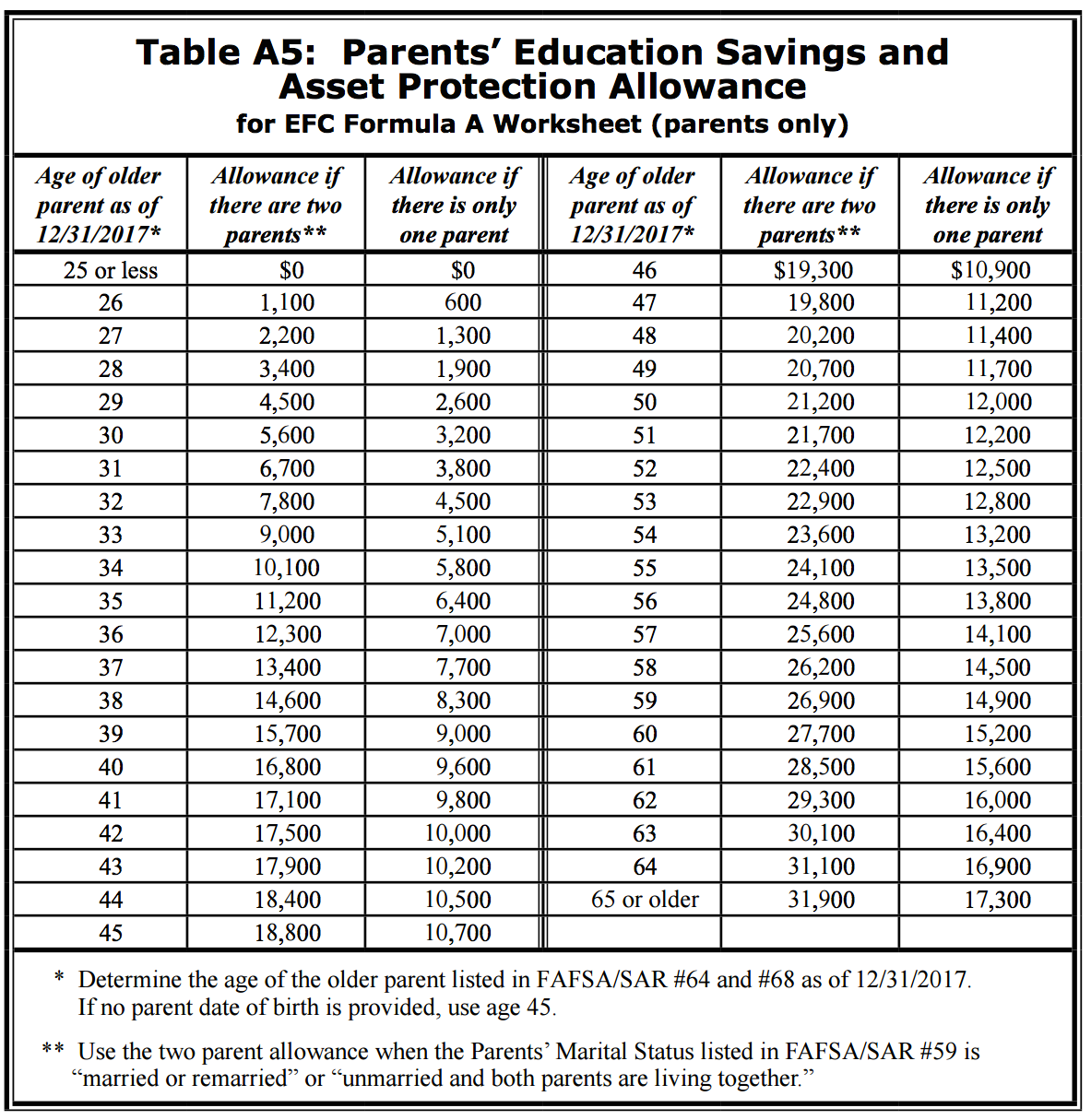

In a rural area we have the same access to support and resources for our students as other areas of the state and Jen is a big part of making that happen. Reportable and non-reportable assets are illustrated in this table. Its fraud not to do so.

Here is an analogy that explains exactly how asset allocation works. The FAFSA may also be used to determine a students eligibility for state and school-based aid and also may influence how much private aid a student receives. The impact of an asset depends on whether it is a student asset or a parent asset.

The Free Application for Federal Student Aid form is used to determine how much a student and his or her family are eligible to receive in federal financial aid. 529 Plan and FAFSA. The lender usually a financial institution is given security a lien on the title to the property until the mortgage is paid off in full.

While the chapter follows the organization of the paper application and the ISIR the guidance applies equally to the FAFSA online. Income is placed into the. Jen is an incredibly valuable asset to my School Counseling program at Audubon High School Walter said.

Your car loses value the moment you drive it off the lot and continues to lose value as time goes on. The FAFSA form is the first step in the financial aid process. The more income and assets the student and parents have obviously the less aid the student will be eligible for.

Fafsa Understanding Parent And Student Assets Lendkey

Fafsa Tips 7 Ways To Get More Financial Aid Money

Do You Need A Certain Credit Score To Lease A Car Student Loan Hero

What Is The Expected Family Contribution Efc For Financial Aid Eligibility Bautis Financial

How To Become An Uber Or Lyft Driver Nerdwallet

Fafsa Basics Parent Assets The College Financial Lady

Fafsa Tips How To Shelter Your Savings And Get More College Aid Money

The Fafsa Asset Protection Allowance Plunges To Near Zero

How To Drive A Nicer Car Than You Thought Possible Money Under 30

What Counts As An Asset On The Fafsa College Raptor

Just How Risky Is It To Lie On Your Fafsa Application College Finance

How Do You Apply For The Fafsa 10 Simple Steps

The Fafsa Asset Protection Allowance Plunges To Near Zero

How To Shelter Assets On The Fafsa

How To Protect Your Assets In The Event Of A Car Accident Nerdwallet

How To Shelter Assets On The Fafsa

Do My Savings Affect Financial Aid Eligibility Money